Discover and compare top brands on our website. We provide unbiased reviews to help you select the best products. While we do receive advertising fees from some brands, we also review non-affiliated brands. Our comparison table is influenced by factors such as advertising fees, conversion rates, reviewer opinions, and product popularity.

Important Notice: Our reviews, ratings, and scores serve as informative tools only and may not be entirely precise. Despite possible changes in offers, we strive to provide the most current information available.

Our website does not include every brand, provider, or offer available in the market. Please take the time to read and understand our 'Terms of Use' as it outlines the extent of our service, and to ensure that it meets your needs.

Use the Finder

Use the Finder

Discover and compare top brands on our website. We provide unbiased reviews to help you select the best products. While we do receive advertising fees from some brands, we also review non-affiliated brands. Our comparison table is influenced by factors such as advertising fees, conversion rates, reviewer opinions, and product popularity.

Important Notice: Our reviews, ratings, and scores serve as informative tools only and may not be entirely precise. Despite possible changes in offers, we strive to provide the most current information available.

Our website does not include every brand, provider, or offer available in the market. Please take the time to read and understand our 'Terms of Use' as it outlines the extent of our service, and to ensure that it meets your needs.

What Is an Invoice?

- Invoice Software Finder

- Invoices Types

- What Is an Invoice

In our next blog post, we'll explain what an invoice is, why it's important for business, and what it contains. This information is important for managing financial records and payments.

For Start: What Invoice Mean?

An invoice is an important document for any business transaction that serves as a record of the goods and services that have been sold, and as proof of payment. It includes information such as the item or service being purchased, the quantity and unit price of the item or service, any discounts or taxes associated with the purchase, payment terms and contact information for both parties involved in the transaction. Invoices are essential for keeping track of financial records, and protect both the buyer and the seller in any business transaction. They ensure that payments are made on time and accurately to both parties involved in the transaction.

Why are Invoices Important?

An invoice is a document that serves as proof that a commercial transaction has taken place between a buyer and a seller. It includes important information such as the items or services sold, the quantities and unit prices, discounts, taxes, payment terms and the contact information of both parties involved in the transaction.

Invoice is extremely important for any business as it provides evidence of the transaction, without it, there may be a difficulty in proving that a sale has occurred and disputes may arise over payments. Also, keeping track of invoices gives clear visibility into a company's cash flow, knowing which customers owe and when payments are due, making it easier to manage finances and plan for future expenses.

What are the details of invoice?

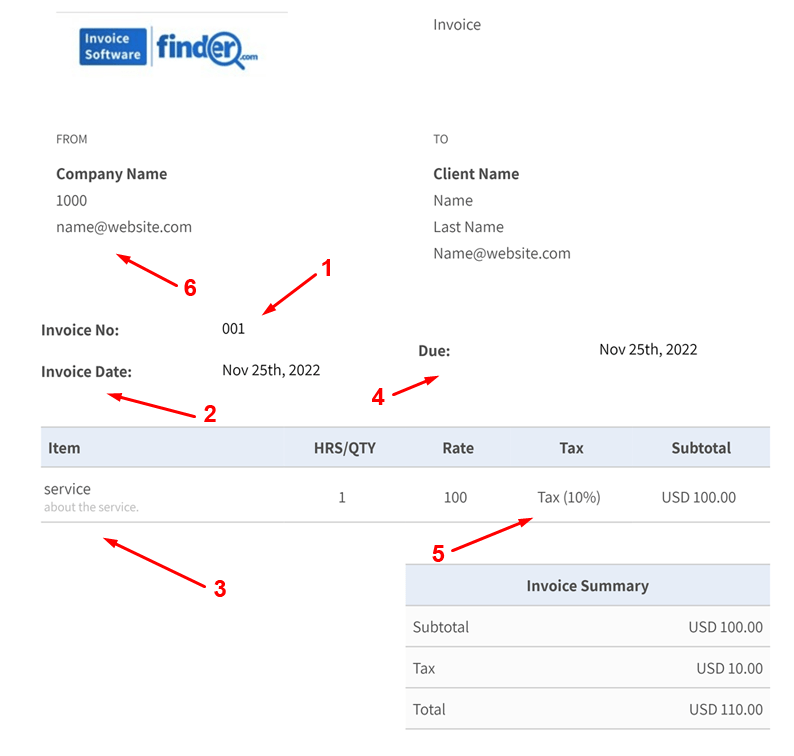

Invoices include the following details and information:

- Invoice number – A unique number used to identify the invoice (you can read here more information about invoice number).

- Invoice date – The date that the invoice was created.

- Description of services / products sold – A detailed description of the products / services sold and their associated costs.

- Payment terms – Information related to when payment is due, what methods of payment are accepted, etc.

- Tax information – Any applicable taxes due on the transaction. This may vary depending on where you are located and what type of product/service was sold.

- Contact information – Contact details for both the buyer and seller should be included on all invoices. such as invoice addresses, phone, names, and more.

Each number is shown in the example below:

How Do You Use an Invoice?

When creating an invoice, it’s important that you include all necessary information such as item descriptions, prices, terms of sale, and discounts offered. This ensures that there are no misunderstandings about what was purchased or how much it costed. Additionally, it’s important to include your contact information so customers know who to contact if they have any questions about the bill. Once you have created your invoice, you can either print it out and send it through mail or email it directly to your customer's inboxes.

You can also use invoices for tracking payments from customers over time. By keeping track of when payments are made (or not made), you can easily identify which customers are overdue on their payments and take appropriate action accordingly. Having this kind of financial visibility into your accounts receivable ensures that you are able to manage your cash flow effectively while also maintaining strong relationships with your customers.

The Differences Between Invoices and Receipts

The main difference between an invoice and receipt is that an invoice is sent before payment has been made while a receipt is sent after payment has been made. This means that an invoice will contain additional information such as payment terms while a receipt will not contain this type of information since it assumes that payment has already been made. Additionally, invoices are generally sent in advance while receipts are usually sent after goods have been delivered or services have been provided.

What Is an Invoice in Accounting?

An invoice is a document that a seller gives to a buyer. It shows what was bought, how much it costs and when payment is due. Invoices act as proof of purchase and can also be used for tax purposes. They also help keep track of what has been paid and what needs to be paid. It is important for businesses to use invoices to stay organized and make sure payments are made on time.

What Is an Invoice in Business?

an invoice is a document that acts like a financial detective, it keeps track of all the clues and evidence of a transaction that took place between a buyer and a seller. The invoice is the ultimate accounting document that allows companies to request payment for the goods or services they provided to their customers.

Think of it as an investigation file, it contains all the necessary information such as the name and address of the seller, the items purchased, the quantities, the prices, the payment terms and the due date, any discounts or taxes applied and any other relevant information.

Just like a detective, an invoice helps keep track of what has been paid for, what needs to be paid for, and helps identify any suspicious or overdue payments. It also helps businesses to keep accurate records of their expenses and income, making it easier to track their performance over time and make better decisions for the future. So, the next time you receive an invoice, think of it as a financial detective, working hard to keep your business running smoothly and efficiently.

Q&A

How do I create an invoice?

To create an invoice, you will need to gather information about the goods or services you sold, the quantity, unit prices and any discounts or taxes. You'll also need to include the payment terms, your contact information and the customer's contact information. You can create an invoice using software, by using an invoice template or by creating your own design from scratch. You can see here lots of free invoice solutions.

How do I send an invoice?

Once you have created your invoice, you can send it through mail or email it directly to your customer's inboxes. You also can use invoice software that can automate the process.

What should I include on my invoice?

he information that should be included in an invoice are: a clear description of the products or services provided, the quantity of items, the unit prices, discounts or taxes applied, payment terms, payment due date, your company's name, address, contact number and email and your customer's name and address.

What software can I use to create invoices?

There are many online invoice software available, such as:

- Zoho Invoice: An online invoicing software with various pricing plans.

- Freshbooks: An online invoicing and accounting software with a free trial and paid plans.

- Xero: An online accounting software that allows you to send invoices and track expenses with different pricing plans.

All of the above-mentioned are online invoice software thats allows you to create, send and track your invoices online, with features such as customizable invoice templates, automatic payment reminders, and integration with other accounting software.

Are there any invoicing best practices I should be aware of?

- Send invoices out promptly and consistently.

- Use a clear and consistent layout.

- Include all necessary information.

- Use a unique invoice number.

- Specify payment terms.

- Send payment reminders.

- Be professional.

Conclusion

In conclusion, invoices are an essential document for any business transactions, as it serves as proof of payment and record of goods and services sold. It is important for keeping track of financial records, protecting both the buyer and seller, and ensuring timely payments. Invoices include important information such as the items or services sold, the quantities and unit prices, discounts, taxes, payment terms, and contact information of both parties. It can be used for tracking payments and for tax purposes, it is sent before payment has been made. and it should include all necessary information and sent either by mail or email. The main difference between an invoice and receipt is that an invoice is sent before payment has been made while a receipt is sent after payment has been made.

- Proforma Invoice

- Invoice Order

- Split Invoice

- Dummy Invoice

- Ad Hoc Invoice

- Mock Invoice

- Pro Rata Invoice

- Excise Invoice

- Mixed Invoice

- Bid Invoice

- Inward Invoice

- Gross Invoice

- Replacement Invoice

- Interim Invoice

- Utility Invoice

- Pending Invoice

- Certified Invoice

- Commercial Invoice

- Progress Invoice

- Timesheet Invoice

- Value Based Invoice

- Recurring Invoice

- Final Invoice

- Past Due Invoice

- Tax Invoice

- Retail Invoice

- Credit Invoice

- Debit Invoice

- Expense Report

- Self Billing Invoice

- Electronic Invoice

- Collective Invoice

- Customs Invoice

- Blank Invoice

- Prepayment Invoice

- Job Invoice

- Contractor Invoice

- Consular Invoice

- Factoring Invoice

- Nota Fiscal

- Commercial Tax Invoice

- Purchase Invoice

- Sales Invoice

- Zonal Invoice

- Transport Invoice

- Packing List Invoice

- Real Time Invoice

- Online Invoice

- Cancellation Invoice

- Adjustment Invoice

- Vendor Invoice

- VAT Invoice

- Withholding Tax Invoice

- Service Invoice

- Statement Invoice

- Summary Invoice

Hear it from our satisfied customers.

-

Emma WilliamsOverall, I highly recommend Invoice software finder for any business looking to buy an invoice software.

-

Nitzan MandowskyInvoice Software Finder simplifies the search process with its AI-based search tool and wide range of options. Highly recommend it for finding the perfect invoicing software.

-

Dvir NagarI recently discovered Invoice Software Finder, an online invoice software comparison site that has been a game changer for my business. It makes it easy to compare different software options based on factors such as features, pricing, user-friendliness, and customer support. The site is well-organized and offers free and paid options. Highly recommend it to any business looking for an efficient way to compare invoicing software options.

-

Daniel OvadiaI was impressed with the invoice software finder website. It made it easy to find the perfect invoicing solution for my business. The user-friendly interface and AI-powered search tool made it a breeze to compare different options and find the one that met all my needs. The reviews and guides were also very helpful in making my decision. I highly recommend this website to any business looking for an efficient and accurate way to find the best invoicing software.

Online Invoicing Software Experts

Are you in search of the perfect online invoicing software for your business? You're in luck! Our expert team dives deep into the top solutions to find the best options just for you. Whether you're just starting out or are already running a large company, we look at everything important - like what features are available, how much it'll cost, how easy it is to use, and how good their customer support is. Our mission? To help you find the invoicing software that fits your unique needs like a glove, making your work faster and easier.